Welcome back to "Wealthy Waters," where we navigate the complex currents of global economics. Today, let's dive into the deep waters of the U.S. budget deficit, a topic that's making waves in the fiscal ocean.

In October, the U.S. Treasury reported a significant reduction in the federal budget deficit, a 24% decrease from the previous year, bringing it down to $67 billion. This is the smallest October deficit since 2017, a sign that the fiscal ship might be steadying itself after a stormy period. This decrease is partly due to a surge in revenues, which climbed to a record $403 billion for the month, boosted by delayed tax payments from disaster-stricken areas.

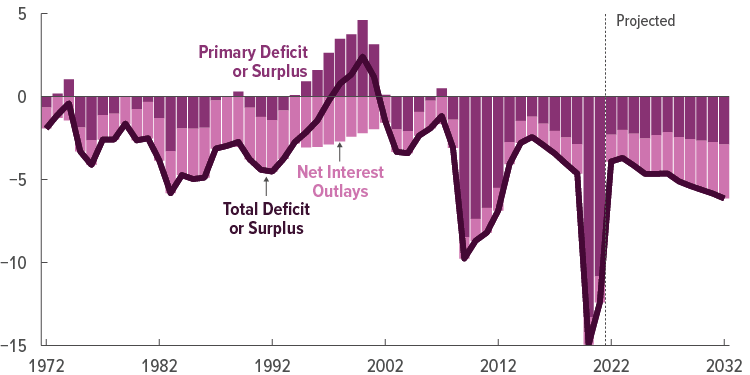

However, this silver lining comes with its own clouds. The interest payments on the U.S. government's debt have soared, accounting for a significant portion of the outlays. The aggressive measures taken by the Federal Reserve to curb inflation have led to a sharp increase in interest rates, pushing the interest costs on the national debt higher. In October alone, interest on the debt was the second-largest outlay after Social Security payments.

This situation is a stark reminder of the delicate balance between stimulating economic growth and maintaining fiscal responsibility. The surge in interest rates, while necessary to control inflation, has a direct impact on the cost of servicing national debt. It's like a ship trying to navigate through a narrow passage; every move must be calculated to avoid running aground.

The looming possibility of a government shutdown if Congress fails to pass a continuing resolution by November 17 adds another layer of complexity to the fiscal landscape. It's a reminder of the ongoing challenges in steering the ship of state, where political and economic currents often intersect.

As we ponder these developments, my perspective as an author and economic observer is that fiscal management is an art of balance. The recent reduction in the deficit is a positive sign, but the rising interest costs and the potential government shutdown underscore the ongoing challenges. It's about finding a course that promotes economic growth while keeping the debt burden manageable.

So, fellow navigators, what are your thoughts on this fiscal journey? How do you see the interplay between economic growth, inflation control, and fiscal responsibility shaping the future? Share your insights, and let's continue this voyage of understanding together. Until next time, keep your compass true and your ledger balanced. Let's sail these fiscal waters with wisdom and foresight.